Baazov Bid for Amaya Likely a Bluff, Share Price Has Stabilized Anyway

More and more empirical data accumulates that indicates that the supposed plan announced last month by Amaya Gaming CEO David Baazov to repurchase the parent company of PokerStars and take the online-gambling giant was a giant bluff, designed to stabilize the company’s share price in the face of a wave of adverse news and very public fear-mongering market short-sellers.

It was just one month ago that Baazov announced a plan to purchase the company in an all-cash deal backed by a handful of unnamed corporate investors. The suggested buy price was CAD $21/share, which was over the stock’s valuation at the time of the deal but was still little more than half the value of the deal of Amaya’s biggest corporate asset, that being Oldford Group, the holding company that contains PokerStars and Full Tilt.

It was just one month ago that Baazov announced a plan to purchase the company in an all-cash deal backed by a handful of unnamed corporate investors. The suggested buy price was CAD $21/share, which was over the stock’s valuation at the time of the deal but was still little more than half the value of the deal of Amaya’s biggest corporate asset, that being Oldford Group, the holding company that contains PokerStars and Full Tilt.

In line with regulatory requirements, Amaya duly issued a notice announcing the private offer, albeit with this caveat:

“As of the time of this release, the special committee has neither received nor solicited a formal bid or offer related to a potential transaction and there can be no assurance that Mr. Baazov’s intention will result in a formal bid or offer or that any such bid or offer will ultimately result in a completed transaction.”

Baazov had announced, and Amaya as a company had confirmed, a tentative deadline of March 1st for a formal bid to made. Except March 1st has now come and gone with no bid, and this week, Amaya confirmed that Baazov and his undefined, perhaps-no-longer-extant group had not yet made that formal bid, and that because of the indeterminate nature of the situation, Amaya would be delayed two weeks in issuing its 2015 Q4 and year-end numbers.

Meanwhile, all the short-sellers that had attempted to drive the AYA share price downward have seen their own options increasingly diminished and devalued.

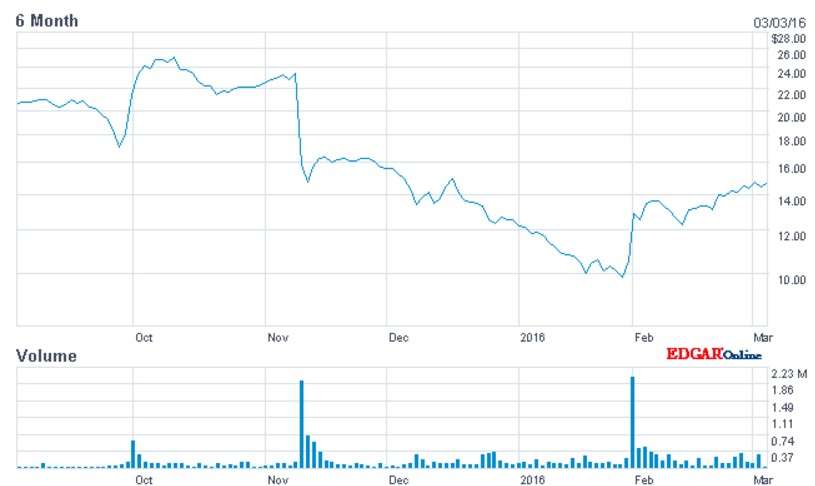

A glance at a simple 6-month time chart tracking Amaya’s share price readily tells the story. Here’s what NASDAQ offers (and note that this chart shows USD instead of CAD for the value at the right; in Amaya’s native Canadian currency, the numeric value is one third higher — US $1.00 equals CA $1.33 these days.)

(Source: EDGAR Online, via NASDAQ)

The early November dip in Amaya price came after the company announced it would fall short of its 2015 Q3 projections, which triggered a sell-off. On February 1st, the stock jumped the opposite way on the news of the supposed Baazov bid. Yet it’s the slide between those two activity spikes, from mid-November through January, that may be the real story. That’s the ten weeks or so in which several short-sellers publicly attacked Amaya, likely creating generalized market fear and uncertainty.

Baazov’s bid put an end to that, establishing a floor below which Amaya’s stock is likely not going to drop. With wobbles of a few thin Canadian dimes, Amaya’s stock has held steady above CA $19/share, even edging a little bit higher these days on news of PokerStars’ imminent return to the US market, in the online-poker-friendly state of New Jersey.

Despite that fact that the supposed Baazov bid of $21/share is still higher than the current Amaya price, I’d be surprised if Baazove and his group don’t back away from the bid, likely with a statement that the company’s suddenly-rosier fortunes have made it likely that such a bid wouldn’t be accepted anyway. On the Amaya side, that contingency is already covered; even in Baazov and his group made a formal bid, the company need not accept it.

From this week’s statement about the delayed results: “There can be no assurance that Mr. Baazov’s group will make an offer or that any such offer will ultimately result in a completed transaction.”

Indeed. That said, the tentative bid announcement appears already to have served its greater purpose, putting a floor beneath Amaya’s numbers and keeping the company from being the target of panic-pumping opportunists.

Well played, Mr. Baazov.

COMMENTS